Is ESG Making the Job Market More Polarized?

Recent debates over corporate social responsibility reveal deepening divides in how companies engage with environmental, social, and governance (ESG) issues. Public discourse around corporate responsibility has intensified, with the U.S. emerging as a focal point following the 2024 presidential election. Several large firms have publicly reduced their ESG commitments; for example, Google recently eliminated its hiring goals for historically underrepresented groups and signaled a reassessment of its diversity, equity, and inclusion (DEI) programs. Conversely, other major corporations, such as Costco and Microsoft, among others, have reaffirmed their ESG commitments. These divergent strategies highlight the increasingly polarized landscape of corporate social responsibility, where strategic engagement with ESG practices plays a growing role in defining corporate identity.

This evolving landscape raises critical questions about the impacts of firms’ engagement with ESG on job-seeker preferences and broader labor dynamics. Do corporate ESG practices matter for job-seekers? Are job-seekers uniformly responsive to ESG practices, or do meaningful differences in preferences exist across sociodemographic lines? What are the broader implications of ESG on talent allocation, wage inequality, and labor market efficiency?

In Colonnelli et al. (2025a), we explore the implications of ESG practices in the context of Brazil, one of the world’s largest emerging economies. While public discourse on ESG has largely centered on the U.S. and Europe, emerging markets provide a unique and understudied context to examine these questions.

Insights from Brazilian Firms

To motivate our analysis, we begin by presenting insights from a survey we conducted on ESG adoption among 1,067 Brazilian firms. In particular, we asked firm owners about their firms’ current and intended ESG practices and key adoption drivers. Two key findings emerged:

- ESG Matters for Talent Attraction and Retention: Firm owners view talent attraction and retention as an important benefit of ESG adoption, alongside other drivers such as alignment with firm values and regulatory compliance.

- ESG Adoption is Heterogeneous Across Firms: Larger, higher-paying firms and those with a more educated workforce are more likely to invest in ESG.

Job-Seeker Preferences for ESG

Motivated by these insights, we next examine whether job-seekers value the ESG practices of potential employers through a field experiment conducted in collaboration with one of the largest job-matching platforms in Latin America. Through an incentive-compatible survey, job-seekers rate synthetic job postings (i.e., postings that were created by our research team but are designed to appear realistic) that vary in ESG signals, nonwage amenities, and other job and firm attributes.

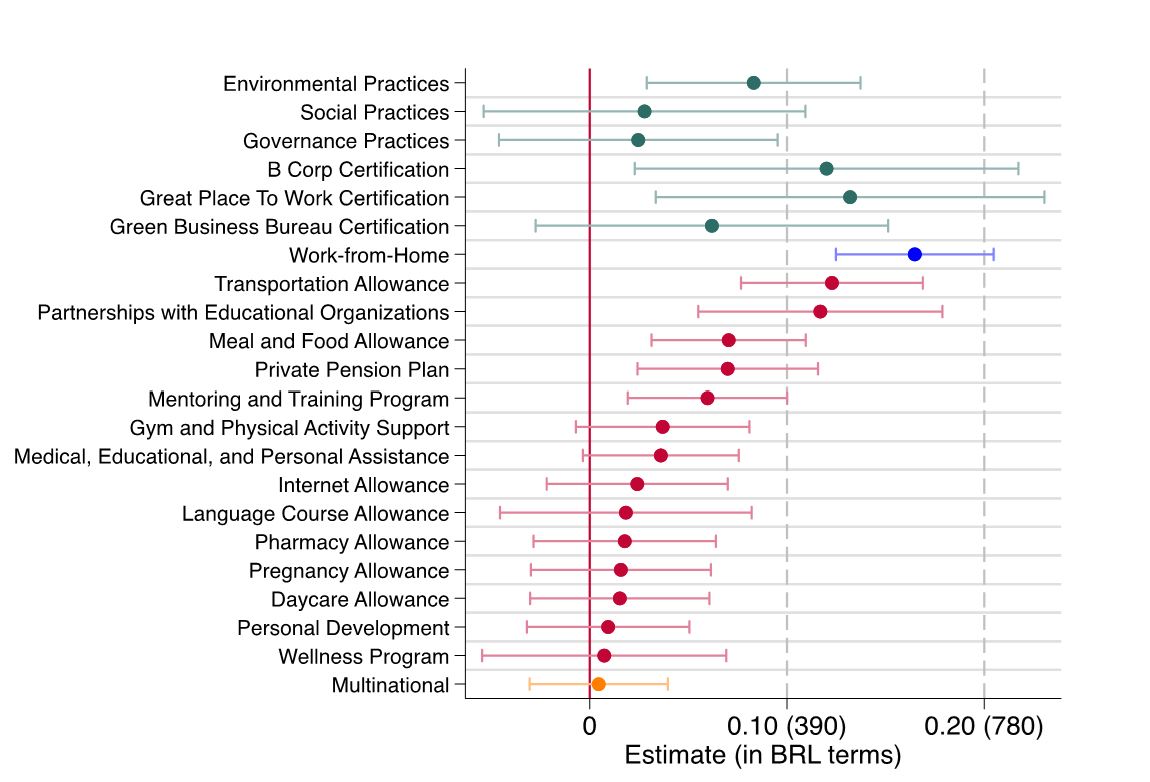

We first document a strong average preference for ESG among job-seekers, who value the ESG signal as equivalent to 10% of average wages in our sample. Figure 1 compares the impact of ESG signals on job-seeker interest to that of other nonwage amenities and firm characteristics, and we highlight a few key findings below:

- ESG is More Influential than Most Nonwage Amenities: ESG has a stronger impact on job-seeker interest than most other nonwage amenities and firm attributes, including working for a multinational company, medical allowances, and mentoring, training, and personal development programs.

- ESG is Comparable to High-Value Amenities: ESG signals are valued similarly in magnitude to meal and food allowances and private pension plans.

- Few Nonwage Amenities are More Important Than ESG: Although ESG is highly valued, it generates about 60% as much interest as work-from-home arrangements. Certain amenities—such as transportation allowances and educational partnerships—also generate greater interest among job-seekers.

Figure 1: Job-Seeker Preferences for ESG Practices and Nonwage Amenities

How Polarizing Is ESG Compared to Other Nonwage Amenities?

A natural next question that arises is whether preferences for ESG are heterogeneous across sociodemographic groups. In our companion paper, Colonnelli et al. (2025b), we further extend our main analysis to explore whether ESG is uniquely polarizing compared to other nonwage amenities. Specifically, we examine heterogeneous preferences for ESG and 17 other nonwage amenities across the following sociodemographic lines: education, race/ethnicity, political orientation, age, and gender.

Figure 2 presents the main results of this analysis, and we discuss several key findings below:

- ESG is the Most Polarizing Nonwage Amenity: Preferences for ESG are highly polarized across multiple sociodemographic dimensions. We observe that preferences for ESG are strongest among those who are highly educated (i.e., those who hold a college degree or higher), white, and those self-identifying as politically liberal or moderate.

- Heterogeneous Preferences for Environmental and Governance Practices: Breaking down ESG signals into environmental, social, and governance categories, we find that preferences for environmental practices are strongest among white and politically liberal or moderate individuals, while highly educated individuals exhibit the greatest preferences for governance practices. In contrast, social practices show no significant variation across demographic groups.

- Most Other Amenities Exhibit No Meaningful Sociodemographic Differences: For the majority of nonwage amenities—including private pension plans, medical benefits, educational assistance, personal assistance, and mentoring and training programs—preferences do not vary significantly across any sociodemographic lines.

- Two Exceptions: Work-From-Home and Personal Development: Only two amenities—work-from-home policies and personal development programs—showed meaningful differences across sociodemographic dimensions. Women more strongly favored work-from-home than men, and highly educated job-seekers placed a higher value on personal development programs compared to those without a college degree. Even for these two amenities, however, the differences were limited to a single sociodemographic dimension.

Overall, ESG emerges as the most polarizing amenity and exhibits far greater degrees of heterogeneity across multiple dimensions, including education, race, and political orientation. This pronounced polarization suggests that ESG preferences may be more closely tied to personal values and social identity compared to other nonwage amenities. As a result, ESG signaling may be a powerful yet potentially divisive tool for attracting talent.

Figure 2: Preferences for ESG Practices and Nonwage Amenities Across Sociodemographic Groups

Implications of ESG on Labor Market Dynamics

To understand the broader implications of ESG for the labor market, we combine our experimental estimates with matched employer-employee administrative data and develop a structural model of the labor market. This model enables us to analyze how varying levels of ESG adoption across firms affect the distribution of skilled and unskilled labor, wage differentials, allocative efficiency, and worker welfare.

The key findings from our structural model are:

- ESG Increases Value Added: Labor value added increases by 0-0.7% relative to a baseline economy without ESG. This effect arises due to improved allocative efficiency, as high-skill workers who value ESG better sort into more productive firms.

- ESG Increases Wage Inequality: Wage inequality between skilled and unskilled workers increases by 0-4% under heterogeneous ESG adoption. This occurs because the improved labor allocation increases the total wage bill in the economy. The resultant increase in wage bill primarily accrues to skilled workers, who value ESG the most and respond to its introduction.

- ESG Increases Worker Utility: Total worker utility increases on the order of 0-5% relative to the baseline. This effect arises both through direct utility gains from working for ESG-adopting firms and through indirect benefits from improved allocative efficiency.

These findings suggest that ESG can enhance overall welfare while contributing to wage inequality between skilled and unskilled workers, highlighting its complex role in influencing broader labor market outcomes.

Conclusion

This paper provides new evidence on how ESG practices influence labor market dynamics and talent allocation, with a particular focus on the polarizing nature of ESG as a nonwage amenity. By examining these questions in Brazil, we contribute to the broader debate on the role of organizational values in influencing job-seeker preferences and labor market outcomes. As ESG continues to shape corporate identity and workforce composition, understanding its nuanced effects will be crucial for both firms and policymakers navigating an increasingly polarized and values-driven job market.

References

Colonnelli, E., T. McQuade, G. Ramos, T. Rauter, and O. Xiong (2025a): “Polarizing Corporations: Does Talent Flow to “Good” Firms?” Available at SSRN 4645695.

Colonnelli, E., T. McQuade, G. Ramos, T. Rauter, and O. Xiong (2025b): “ESG is the Most Polarizing Nonwage Amenity: Evidence from a Field Experiment in Brazil,” AEA: Papers and Proceedings, forthcoming.

Distribution channels: Education

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release