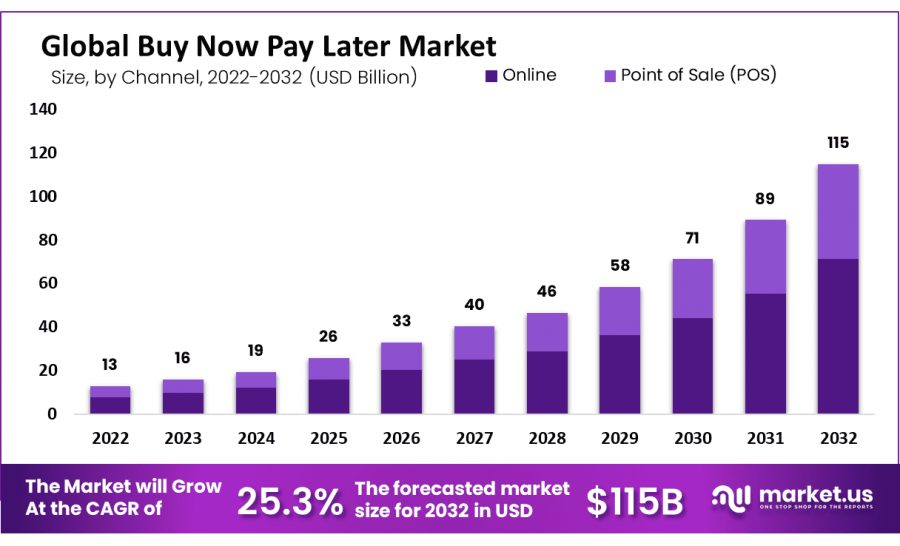

Buy Now Pay Later Market Boost Finance Sector By USD 115 billion by 2032, CAGR of 25.3%

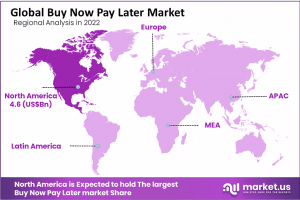

Regionally, North America led the BNPL market in 2022, with a share exceeding 32% and generating revenues of around USD 4.6 billion...

NEW YORK, NY, UNITED STATES, February 5, 2025 /EINPresswire.com/ -- The global Buy Now Pay Later (BNPL) market is projected to grow substantially from USD 16 billion in 2023 to USD 115 billion by 2032, with an impressive CAGR of 25.3%.

This growth is driven by increasing consumer demand for flexible payment solutions that allow immediate purchases with deferred payments, often interest-free when payments are made on time. This model is gaining traction, particularly among younger demographics such as millennials and Gen Z, who prioritize financial flexibility and convenient shopping experiences.

The BNPL market benefits significantly from the rising popularity of e-commerce and digital financial solutions. As more consumers shop online, the demand for seamless, hassle-free payment methods grows. Online channels captured over 62% of the BNPL market in 2022, underscoring this trend.

🔴 𝐃𝐢𝐫𝐞𝐜𝐭 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 @ https://market.us/report/buy-now-pay-later-market/request-sample/

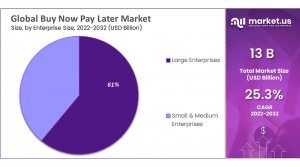

Large enterprises, leveraging extensive resources and customer bases, dominate the BNPL market with a 61% share, utilizing these services to improve customer acquisition and retention. Additionally, the retail sector leads with over 71.3% market share, utilizing BNPL to enhance purchase power and sales.

North America's market dominance, with more than a 32% share in 2022, reflects widespread consumer and merchant acceptance of BNPL solutions, underpinned by a mature digital infrastructure and an open regulatory environment.

Key Takeaways

The Buy Now Pay Later (BNPL) market is poised for substantial growth from USD 16 billion in 2023 to USD 115 billion by 2032, with a CAGR of 25.3%.

The online segment dominated the BNPL market in 2022 with over 62% market share, driven by the growth in e-commerce.

Large enterprises hold a leading position in the market with 61% share, using BNPL to enhance customer acquisition.

The retail sector captured more than 71.3% of the market share in 2022, leveraging BNPL to boost consumer purchasing power.

North America led the BNPL market in 2022, with over 32% market share, benefiting from broad consumer and merchant acceptance.

🔴 𝐇𝐮𝐫𝐫𝐲 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 𝐅𝐨𝐫 𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲 @ https://market.us/purchase-report/?report_id=103992

Experts Review

Industry experts emphasize several factors driving the rapid growth of the BNPL market. Government incentives and regulatory guidance are crucial, as these measures ensure consumer protection while fostering innovation. Regulations aim to balance transparency and accountability with the industry's growth potential, particularly as BNPL becomes integral to modern retail and financial ecosystems.

Technological innovations play a pivotal role, with advancements in AI and machine learning enabling personalized payment solutions and enhancing fraud prevention mechanisms. These developments increase consumer confidence and broaden BNPL's appeal across diverse demographics.

Investment opportunities are abundant, reflecting the market's expansion potential. However, investors face risks related to consumer creditworthiness and regulatory hurdles. Managing these risks is essential for sustaining growth and maintaining market competitiveness.

Consumer awareness is rising, driven by marketing campaigns and strategic partnerships. Increased familiarity with BNPL options enhances their integration into consumers' financial routines. The regulatory environment, although supportive, demands compliance with evolving standards, impacting operational strategies and market approaches.

Overall, BNPL's impact on financial services is transformative, offering flexible financial solutions and reshaping consumer retail interactions, while necessitating careful management of regulatory and market expansion challenges.

🔴 𝐓𝐨 𝐆𝐚𝐢𝐧 𝐠𝐫𝐞𝐚𝐭𝐞𝐫 𝐢𝐧𝐬𝐢𝐠𝐡𝐭𝐬, 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐚 𝐬𝐚𝐦𝐩𝐥𝐞 𝐫𝐞𝐩𝐨𝐫𝐭 @ https://market.us/report/buy-now-pay-later-market/request-sample/

Report Segmentation

The BNPL market is segmented by channel, enterprise size, and end-user.

Channel Segmentation: The market is primarily divided into Online and Point of Sale (POS) channels. The online segment holds significant prominence, capturing more than 62% of the market share in 2022, driven by the global expansion of e-commerce and consumers' shift towards digital shopping.

Enterprise Size Segmentation: Large Enterprises dominate with over 61% market share, leveraging robust infrastructure and financial strength to integrate BNPL solutions effectively across global operations. These enterprises benefit from brand trust and extensive customer bases, facilitating smoother adoption and enhanced scalability of BNPL services.

End-User Segmentation: The market serves various sectors, including Banking, Financial Services & Insurance (BFSI), Consumer Electronics, Fashion & Garment, Healthcare, Leisure & Entertainment, and Retail. The retail sector leads, with a 71.3% market share in 2022, highlighting the synergy between retail and BNPL in providing flexible payment options that boost consumer purchasing power and sales.

Geographically, North America leads, followed by Europe and Asia Pacific, reflecting strong market adaptation and regulatory support. Each region's market dynamics are influenced by local consumer behavior, digital infrastructure, and regulatory frameworks tailored to accommodate the growing BNPL services demand.

🔴 𝐆𝐞𝐭 𝐭𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 (𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲) @ https://market.us/purchase-report/?report_id=103992

Key Market Segments

Based on Channel

Online

Point of Sale

Based on Enterprise Size

Large Enterprises

Small & Medium Enterprises

Based on End-User

Banking, Financial Services & Insurance (BFSI)

Consumer Electronics

Fashion & Garment

Healthcare

Leisure & Entertainment

Retail

Other End-Users

Drivers, Restraints, Challenges, and Opportunities

Drivers: The primary driver of BNPL market growth is the surge in e-commerce and digital payment adoption. Consumers increasingly prefer flexible payment options that enable them to distribute expenses over time without additional interest. This trend is supported by the integration of BNPL solutions into digital platforms, enhancing consumer purchasing experiences.

Restraints: Regulatory scrutiny poses a significant challenge, as authorities impose stricter requirements to prevent consumer over-indebtedness. BNPL providers must navigate these regulations while ensuring transparent and fair lending practices, impacting their operational flexibility.

Opportunities: Expansion into diverse sectors such as healthcare and education presents substantial growth potential. BNPL solutions offer manageable payment plans for significant expenses like medical bills or tuition, broadening the service's applicability and consumer base.

Challenges: Intense competition and potential market saturation are major challenges. As more companies enter the BNPL space, maintaining market share and profitability becomes difficult. Providers must innovate continuously, improve consumer experiences, and manage operational costs to remain competitive.

Overall, while the BNPL market faces regulatory and competitive challenges, significant opportunities for expansion and technological innovation exist, underscoring its importance in modern financial ecosystems and consumer transactions.

Key Player Analysis

Key players in the BNPL market are actively expanding their operations and product offerings to capture larger market shares. Companies such as Affirm Inc., Afterpay Pty Ltd, Klarna Inc., and PayPal Holdings, Inc. are at the forefront, leveraging technology and customer service to enhance their competitive edge.

These enterprises focus on strategic partnerships and acquisitions to broaden their reach and service capabilities. For instance, Affirm has introduced new payment options to cater to diverse consumer needs, while Klarna's "Loyalty Card" feature enhances user engagement through reward programs.

Such players dominate by continuously innovating their offerings, ensuring they meet evolving consumer demands for flexible, user-friendly financial solutions. The market remains fragmented, with intense competition from both established companies and fintech startups. To sustain growth, these players invest in marketing, technology upgrades, and regulatory compliance, ensuring they can capitalize on the expanding BNPL landscape effectively.

Top Key Players in the Market

Affirm, Inc.

Afterpay Pty Ltd

Atome

Flipkart Internet Private Limited

Grab Holdings Inc.

Hoolah Holdings Pte Ltd.

Klarna Inc.

LatitudePay Australia Pty Ltd

Laybuy Group Holdings Limited.

Mastercard International Incorporated

Monzo Bank Limited

One97 Communications Limited (Paytm)

Openpay Pty Ltd.

Payl8r (Social Money Ltd.)

PayPal Holdings, Inc.

Perpay Inc.

Sezzle Inc

SPLITIT USA INC.

Zip Co Limited

Other Key Players

Recent Developments

Recent developments in the BNPL market showcase continued innovation and strategic expansions. In June 2024, Affirm launched new flexible payment options, "Affirm Pay in 2" and "Affirm Pay in 30," allowing consumers to split purchases into manageable payments, enhancing consumer financial flexibility.

Klarna expanded its services with the introduction of a "Loyalty Card" feature in July 2023, rewarding users for purchases and increasing customer loyalty. Additionally, Klarna is broadening its reach across various industries, including travel and healthcare, reflecting its adaptive business strategy.

CRED's entry into the BNPL market with "CRED Flash" in February 2023, offering fee-free 30-day payment deferments, marks another significant advancement. This feature partners with over 500 merchants, increasing its utility and consumer access.

These developments highlight the growth trajectory and competitive dynamism within the BNPL market, underscoring a continual shift towards more adaptable, consumer-centric financial solutions that enhance purchasing power and merchant sales.

Conclusion

The Buy Now Pay Later market is undergoing rapid expansion, driven by evolving consumer preferences for flexible payment solutions and the growth of e-commerce. Despite challenges such as regulatory scrutiny and intense competition, the market offers substantial opportunities, particularly in new sectors like healthcare and education.

Key players are leveraging technological advancements and strategic partnerships to enhance their offerings, catering to diverse consumer needs. As the market continues to innovate, it holds the potential to transform traditional retail and financial interactions, making it an integral part of the consumer payment ecosystem going forward.

➤ 𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐎𝐭𝐡𝐞𝐫 𝐈𝐧𝐭𝐞𝐫𝐞𝐬𝐭𝐞𝐝 𝐓𝐨𝐩𝐢𝐜𝐬

Digitally Printed Wallpaper Market - https://market.us/report/digitally-printed-wallpapers-market/

AI in Logistics Market - https://market.us/report/ai-in-logistics-market/

Online Gaming Market - https://market.us/report/online-gaming-market/

Robot Software Market - https://market.us/report/robot-software-market/

Salesforce CRM Document Generation Software Market - https://market.us/report/salesforce-crm-document-generation-software-market/

Factoring Market - https://market.us/report/factoring-market/

Retail Banking Market - https://market.us/report/retail-banking-market/

AI in HR Market - https://market.us/report/ai-in-hr-market/

Artificial Intelligence Market - https://market.us/report/artificial-intelligence-market/

AR and VR in Education Market - https://market.us/report/augmented-and-virtual-reality-in-education-market/

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release