Plevin PPI Still Exists, and Thousands of Consumers Are Missing Out on Up to £40,000 in Cash Owed.

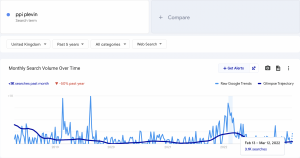

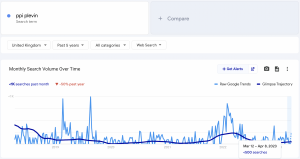

BIRMINGHAM, UNITED KINGDOM, April 25, 2023/EINPresswire.com/ -- Google shows that there has been a drop of 83.33% in searches of Plevin PPI to less than 500 per month compared to over 3000 last year. But thousands of individuals could be owed anywhere up to £40,000 in compensation from missold payment protection insurance.

The Plevin ruling, named after Susan Plevin, is a legal precedent that established that if more than 50% of a PPI policy’s cost went towards commission, the customer was entitled to receive compensation. This ruling applies to customers who were previously rejected for PPI claims or who did not make a claim before the deadline.

The Plevin ruling, which is also known as the Plevin case or Plevin v Paragon Personal Finance Ltd, is a landmark legal case in the United Kingdom that has significant implications for customers who were mis-sold Payment Protection Insurance (PPI) policies. The ruling was named after Susan Plevin, a retired college lecturer, who challenged Paragon Personal Finance Ltd over the sale of her PPI policy.

The ruling established that if more than 50% of a PPI policy’s cost went towards commission, the customer was entitled to receive compensation. This means that customers who were sold PPI policies with high levels of commission, but were not made aware of this fact, can now claim compensation for the mis-selling of their policies. The ruling applies to customers who were previously rejected for PPI claims or who did not make a claim before the PPI claims deadline, which was set for August 29, 2019.

Your Claim Matters, a leading claims management company, is encouraging customers to check if they are eligible to claim compensation for Plevin PPI (Payment Protection Insurance). Despite the deadline for PPI claims having passed, Plevin PPI claims are still available for those who were mis-sold PPI policies that had high levels of commission.

Commenting on the Plevin PPI claims service, Steve Reid from your Claim Matters said:

“Everyone has heard of PPI claims… large sums of money that thousands of people were entitled to after being missold payment protection insurance for all kinds of finance from mortgages and loans to credit cards, car and even catalogue accounts. But with the deadline passing in August 2019 interest and enquiries in payment protection claims grounded to a halt. However, as the cost of living crisis continues people really do need to check if they could be owed Plevin PPI,’ a misselling category of PPI that you can still claim for. People could be owed anything from £1,000 to £40,000 which could provide a real lifeline in these unprecedented times.’

He also stated that, “We want to make sure that all customers who were mis-sold PPI policies with high levels of commission receive the compensation they are entitled to. The Plevin ruling means that there is still a chance to claim, even if you previously had your PPI claim rejected or missed the deadline for making a claim. Our team of experienced claims handlers can help guide you through the claims process and make it as easy and stress-free as possible.”

About Your Claim Matters:

Your Claim Matters is a leading claims management company dedicated to helping customers claim the compensation they deserve. With a team of experienced claims handlers and a high success rate, the company provides various claims management services, including Plevin PPI claims, PPI tax rebate and marriage tax allowance.

Laura Masters-Jones

Strategy Plus

+ +44 7791 308922

email us here

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.