$20 Million Sale of Partial IP Asset Sale plus Strong Financial Growth with Projected Acceleration: Stock Symbol: CURR

$20 Million Cash Gain from Partial IP Asset Sale and Strong Financial Growth with Projected Acceleration: CURE Pharmaceutical: (Stock Symbol: CURR)

CURE PHARMACEUTICAL HOLDING CORP (OTCMKTS:CURR)

OXNARD, CALIFORNIA, UNITED STATES, September 21, 2022 /EINPresswire.com/ -- $20 Million Cash Gain from Partial IP Asset Sale and Strong Financial Growth with Projected Acceleration: CURE Pharmaceutical: (Stock Symbol: CURR)

Patented Techniques Improve Efficacy, Safety, and Patient Experience.

25,000 Square Foot, FDA-Registered, NSF® and cGMP-Certified Manufacturing Facility.

Positive Growth Q2 Financial Results with Increased Sequential Revenues and Strong Margins.

Q2 Gross Revenue of $1.6 Million, an Increase of 31.2% from Q1 to Q2 with Acceleration Expected in Q3 and Q4.

$20 Million Cash Gain from Sale of a Portion of Platform Technology IP.

CURE Pharmaceutical (OTCQB: CURR) is a fully integrated and progressive drug delivery company. The CURR team has extensive experience formulating and manufacturing OTC products, pharmaceuticals, and veterinary medications placing quality and service as its top priorities, earning the trust and respect of customers worldwide.

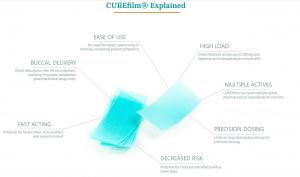

CURR is the pioneering developer of CUREform™, a patented drug delivery platform that offers a number of unique immediate-release and controlled-release drug delivery technologies designed to improve drug efficacy, safety, and patient experience for a wide range of active ingredients.

As a vertically integrated company, CURR operates a 25,000 square foot, FDA-registered, NSF® and cGMP-certified manufacturing facility enabling it to partner with pharmaceutical and wellness companies worldwide for private and white-labeled production. CURR currently has partnerships in the U.S., China, Mexico, Canada, Israel, and other markets in Europe.

2nd Quarter Results with Increased Sequential Revenues and Strong Margins

On September 2nd CURR announced results for the quarter that ended June 30, 2022.

Key operational highlights included the following:

Gross revenue of $1.6 million reflected an increase of 31.2% from Q1 to Q2 with the further acceleration expected in Q3 and Q4.

Gross margins increased and we expect the high margin sales to accelerate with our new marketing initiatives.

SG&A expenses (excluding stock-based compensation) decreased by $3.4 million in the first half of 2022.

Cost reductions and operating leverage helped narrow operating loss by $1.0 million in 2022 (excluding non-cash stock valuation benefit in 2021), even before the July asset sale that will reduce our ongoing cash burn further.

Shareholder Value and Communication Plus Upcoming Investor Events

CURR management is scheduled to attend and hold one-on-one meetings with investors at the following conferences with more to follow:

September 8th - National Investment Banking Association Investor Conference in Hollywood, Florida

September 22nd - Jefferies Innovation in Mental Health - Psychedelics Summit in New York City.

October 25th - Main Event XV LD Micro Small Cap Conference in Los Angeles.

Rob Davidson New Chairman of the Board and Appointment of Rob Costantino as Member of the Board and Audit Committee Chairman

On August 16th CURR announced the appointment of former CEO Rob Davidson to Chairman of the Board of Directors. In addition, CURR announced the appointment of Robert J. Costantino to its board of directors and he has also been appointed as the Chairman of CURE’s Audit Committee. These appointments bring decades of financial experience, as well as a continuity that should enhance the company’s shareholder value initiatives and communications.

Rob Davidson was most recently the CURR Chief Executive Officer from July 2011 to July 2022 and served as Chairman of our Board until January 2019. He continues with CURR in the key roles of product development, creating new patents, and ongoing negotiations of non-dilutive deal transactions. Prior to his role at CURR, Robert Davidson served as Chief Executive Officer of InnoZen Inc., Gel Tech LLC, and Bio Delivery Technologies Inc., and has served on multiple corporate boards. Mr. Davidson was responsible for the development of several drug delivery technologies and commercial brand extensions. He has worked with brands such as Zicam, Chloraseptic™, Suppress™, as well as Pediastrip™, a private label electrolyte oral thin film sold in major drug store chains.

New Board Member

On August 2nd CURR announced the appointment of Gerald Bagg to its board of directors. This strategic addition adds depth to CPG and advertising and brings the number of board members to five.

A 45+ year veteran of the advertising industry, Gerald is best known for pioneering the BRAND RESPONSE advertising approach to campaigns. He is the Chairman and a co-founder of Quigley-Simpson & Heppelwhite, Inc., a more than twenty-year-old full-service advertising agency specializing in strategic planning, marketing, media planning and buying, brand building, creative development, and production.

Sale of a Portion of CURR Platform Technology IP for $20 Million

On July 28th CURR announced that it has sold a portion of its platform technology intellectual property and related assets for $20 million in total consideration. CURR used a portion of the cash proceeds to pay down certain debt obligations and the balance will be used to grow its intellectual property portfolio and its wellness and beauty brands. In addition, CURR retained its remaining proprietary platform technology that it intends to monetize through the commercialization of the technology or through the licensing or sale of the technology.

In a teleconference on August 3rd CURR management expanded in detail on its developments which included the following information:

CURR retained its exclusive rights to all Nutraceutical Nutri-Strip branded products and will continue to develop future products using the technology, including innovative IP in the beauty and pet categories.

CURR owns the rights to a robust family of patents in many areas including, CBD, Cannabis, psychedelics, extraction, topicals, and other Phyto Nutrient actives, and is actively pursuing international transactions to monetize the IP with interested parties.

CURR will continue to invest in the clinical development of other molecule delivery technologies and is engaged in exploratory discussions with other third parties.

The CURR wholly-owned subsidiary The Sera Labs, Inc., a developer, and marketer of wellness and beauty products, with its portfolio of brands and product lines including CBD based and non-CBD based, now has the working capital to relaunch and build the Seratopical Revolution line. The Company recently shipped to over 1,200 Walmart (WMT) stores as well as to CVS and Bed, Bath and Beyond (BBBY) and looks to aggressively grow Seratopical Revolution into a global brand.

For more information on CURE Pharmaceutical, Inc. (OTCQB: CURR) visit: www.curepharmaceutical.com and www.Seralabshealth.com

DISCLAIMER: The products mentioned are THC-free and/or compliant with the 2018 Farm Bill.

This article is purely for informational purposes and is not a recommendation in any way for buying or selling stocks

Mike Redard

CURE PHARMACEUTICAL HOLDING CORP

+1 805-824-0410

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Other

Nicole Kidman's Skincare Routine: @Susan Yara's Reaction & Thoughts | #SKINCARE

Distribution channels: Banking, Finance & Investment Industry, Business & Economy, Companies, Healthcare & Pharmaceuticals Industry, World & Regional

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release