Rabbu Facilitates Short-Term Rental Portfolio Acquisition Funded Through First-Of-Its-Kind Securitized Financing

Non-recourse financing is a consequential step toward a fast-approaching future: the institutionalization of short-term rentals.

An inaugural loan product was just released by CoreVest, a leading lender in the residential real estate space, in partnership with Rabbu, a short-term rental investment platform, to finance a 43-door short-term rental portfolio in Charlotte, NC. The first loan of its kind, CoreVest is empowering the acquisition through securitized financing, a move traditionally reserved for the commercial real estate market.

‘Introducing non-recourse lending to the STR market is both innovative and appropriate,’ says Emir Dukic, CEO of Rabbu. ‘Our goal is to institutionalize short-term rentals; CoreVest’s understanding of STRs as a market product is ahead of its peers and in line with our own.’

CoreVest’s new loan product enabled Rabbu-sourced buyers, a group of seasoned investors in the residential rental industry, to acquire The Home Collection. With units across single-family and multi-family buildings, The Home Collection is a flagship, short-stay portfolio that’s set the bar for Charlotte’s hospitality economy.

‘These loans can and should be securitized,’ says Dukic. ‘The STR market has skyrocketed, and STRs are functioning as tradable assets; as we’ve seen in other capital markets, it's to everyone’s benefit that these investments are not personally backed by individuals.’

With The Home Collection financing, CoreVest sets the precedent for other lenders that securitize with the same investment groups. As institutional activity in the space continues, big providers will be further incentivized to create competitive products to keep up; a benchmark for capital markets. Those products will continue to pave the way for lucrative activity within the asset class, a win for STR investors and the market overall.

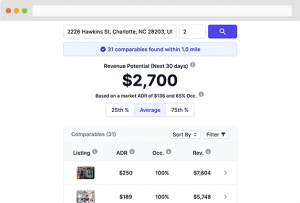

Signs of continued market strength are clear as STR demand floods in from three major channels: international travel, corporate travel, and housing market overflow. Investors and hands-on hosts alike are sustaining occupancy at higher-than-market-average nightly rates. New to market vendors have made it easy not only to abstract the property management component of STR investing, but also to forecast seasonally-adjusted revenue projections and vet potential acquisitions with the same due diligence process that investors apply to other securities.

Through The Home Collection deal, Rabbu has exemplified a potential deal flow that would make large-scale portfolio acquisitions easier for both sellers and buyers. Partnering with sellers Jim Hock and James Funderburk, two well-known short-term rental and corporate rental providers in North Carolina’s real estate market, Rabbu provided prospective investors in their trusted network with financial modeling and revenue projections to represent the potential of STRs as vetted investment vehicles throughout each step of the sale and lender engagements.

Rabbu was also able to undertake the management of each property to streamline and increase returns. In addition to financial modeling, revenue projections, and the engagement of CoreVest, Rabbu offered the sellers a shorter sale period with higher yields and lower-than-average commission.

Now, with a fully-operable, well-managed portfolio and non-recourse financing, the buyers are free to operate as true investors and to do what they do best.

‘CoreVest’s financing of The Home Collection is the first large-scale institutional deal,’ says Dukic. ‘We look forward to working with them in the future on more STR portfolio deals.’

About Rabbu

Rabbu is a turnkey platform for Real Estate investors looking to buy and sell properties as short-term rentals. With proprietary technology, Rabbu automates all aspects of a property’s lifecycle as a short-term rental—from procurement to marketing to operations and guest health and safety. Rabbu helps property investors and managers maximize yield.

About CoreVest

CoreVest is a market-leading lender in the residential real estate space. Founded in 2014 with a mission to meet the demand for affordable debt capital, CoreVest has funded more than 100,000 units and closed over $10 billion in loans nationwide. Operating on the pillars of flexibility and reliability, CoreVest is committed to bringing the future forward and providing investors with the products they need to take part.

About The Home Collection

The Home Collection is the premier provider of luxury accommodations within two miles of Uptown, Charlotte, NC. With the comforts of home and the convenience of hospitality, The Home Collection offers guests an insider’s guide to Charlotte’s luxury living.

Darryl Brisebois

MackaseyHoward Communications

+1 514-718-4171

email us here

Distribution channels: Business & Economy, Companies, Real Estate & Property Management, Technology, World & Regional

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release