Are We Really Headed for A Cashless Society - Our Soul Searching Thoughts Continue at Payments2.0

A Cashless Society

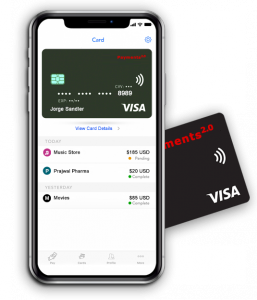

Globally cashless transactions are on the rise, increasing their share of the payments mix each year so r we really headed for a cashless society, Lets Find Out

DUBAI, UNITED ARAB EMIRATES, October 4, 2020 /EINPresswire.com/ -- Globally, cashless transactions are on the rise, increasing their share of the payments mix each year. The seemingly progressive demise of cash presents significant opportunities, particularly for banks. Handling money, including maintaining ATMs, currently accounts for about 10% of banks’ operating expenses. The potential for digital transactions to cut these costs, while allowing for new insights into how customers spend and save, is appealing. For governments and central banks, a cashless economy could help combat fraud and the money laundering that supports criminal activity, while providing information on monetary flows that could guide better policy.

If the world went cashless tomorrow, banks may rejoice at no longer handling notes and coins, which can be counterfeited or stolen. Digital payments would also give banks and payment processors greater information on their customers’ lifestyle. For central banks, digital money could mean more insight into how money flows through the economy, with early warning signs possibly helping monetary policy function more efficiently. But what of the US$1.7b unbanked worldwide? If people rely entirely on cash, they cannot borrow to grow their businesses or improve life for their families, as cash-dependent often means credit-less.

The end of cash as an anonymous and accessible method of payment also raises vital concerns.

1. The first is whether money, or specifically identity, ownership and transactions, could and should go entirely digital.

2, The second is ensuring the transition to digital money leaves no vulnerable populations behind.

Certainly, technology-led innovation is helping bring financial services to the world’s unbanked population for the first time.

Here are some Pro's and Con's to a Cashless Society ... many more can be discussed at some other time.

The Pro's

* Lower crime rates because there's no tangible money to steal

* Less money laundering because there's always a digital paper trail

* Less time and costs associated with handling, storing, and depositing paper money

* Easier currency exchange while traveling internationally

The Cons

* Exposes your personal information to a possible data breach

* If hackers drain your bank account, or you experience technical issues, you'll have no alternative source of money

* Those without bank accounts will struggle to keep up with evolving cashless technology

* Some may find it harder to control spending when they don't see physical cash leaving their hands

Several nations are already making moves to eliminate cash, with the push coming from both consumers and government bodies. Sweden and India are two notable examples, with two different outcomes and much to debate about too quipped Rohan F. Britto from Payment2.0 a company which was short-listed by Fintech India as one of the Top 10 most innovate start-ups in 2019.

Even in countries further along their cashless journey, there are concerns that removing notes and coins altogether may harm vulnerable groups, including the elderly, people with disabilities and rural communities with patchy internet access. Financial inclusion in a digital economy is a significant, complex issue that needs addressing carefully before we move further down the road to do away

with cash.

This is where we return to consumers. Although digital transactions are on the rise, cash is still king in many markets. Most consumers are not ready to completely do away with cash, and many merchants feel the same. The demise of cash is certainly not in the near future but being prepared with a balanced approach along the way for the brands and banks is what we always recommend while keeping a close watch with all the market trends across different geographies.

Rohan Francis Britto

Rijndlpay Technologies Pvt. Ltd

+971 55 635 0635

email us here

Distribution channels: Banking, Finance & Investment Industry, Business & Economy, Companies, Consumer Goods, Culture, Society & Lifestyle, Retail, Social Media, Technology, Telecommunications, World & Regional ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release