Rare Earth Elements ©US Dept of Agriculture

In the complex world of global geopolitics, the quest for minerals and rare-earth elements (REEs) has emerged as one of the most compelling and consequential narratives of the 21st century. These precious resources, often buried deep within the earth’s crust, are something of a lifeblood for our modern world. They power the technology that defines our daily lives, from the smartphones we carry in our pockets to the electric vehicles driving silently along our roads. They are the power behind the towering wind turbines producing clean energy and the sophisticated missile systems safeguarding nations. Elements like lithium, cobalt, and rare-earth metals such as neodymium and dysprosium, among many others, have become indispensable to progress, innovation, and military power.

Yet, the story of these minerals and elements is far from simple. Their extraction and control have sparked a complex set of geopolitical rivalries, environmental challenges, and serious ethical questions. As the demand for these resources surges, nations find themselves entangled in an intense game of resource diplomacy, where the stakes are nothing less than economic dominance, technological supremacy, and strategic influence. The United States, China, Russia and other powers are at the forefront of this contest, each vying to secure access to these critical materials. Meanwhile, countries like Ukraine, Greenland, Canada, and many African nations have found themselves thrust into the spotlight, their lands and resources becoming the focal points of this game of high-power politics.

But this scramble for resources also has a much darker side. The environmental effects of mining operations, often carried out in ecologically sensitive areas, has raised alarms about sustainability and the long-term health of our planet, as well as ethical concerns, as the extraction of these minerals is sometimes linked to exploitative labour practices and the marginalisation of local communities. The geopolitical tensions surrounding these resources can actually reshape alliances, ignite conflicts, and redefine the balance of power on the global stage.

The quest for minerals and rare-earth elements is more than just a race for economic gain—it describes humanity’s aspirations, challenges, and contradictions in an increasingly interconnected and resource-hungry world. The decisions made today, by nations and corporations alike, will echo far into the future, shaping the path of technological progress, environmental responsibility and global stability.

| The Geopolitical Chessboard: Ukraine, Greenland and Beyond

The United States has recently turned its full attention to Ukraine, a country whose significance extends far beyond its role as a strategic buffer between NATO and an increasingly assertive Russia. Ukraine possesses vast reserves of lithium, titanium, and rare-earth elements (REEs)—resources that have become the lifeblood of modern technology and defence industries. For the United States, Ukraine’s mineral wealth represents a major opportunity to recalibrate the global balance of power. At present, China holds a near-monopoly over the supply chain for these critical materials, a dominance that has left Western nations vulnerable to economic and strategic coercion. By cultivating ties with Ukraine, the US aims to diversify its sources of these essential minerals, consequently reducing its reliance on Beijing and bolstering its own technological and military independence.

But this endeavour is far from straightforward as Ukraine remains embroiled in a long and violent conflict with Russia in a struggle that has left its eastern regions badly scarred by war and its sovereignty perpetually under threat. Adding to the challenge is Ukraine’s internal political instability, which has seen periods of upheaval and uncertainty, further complicating efforts to establish reliable partnerships. For Western powers, engaging with Ukraine is a high-risk, high-reward proposition—a gamble that could bring immense strategic and economic dividends, but one that also has the potential for significant setbacks.

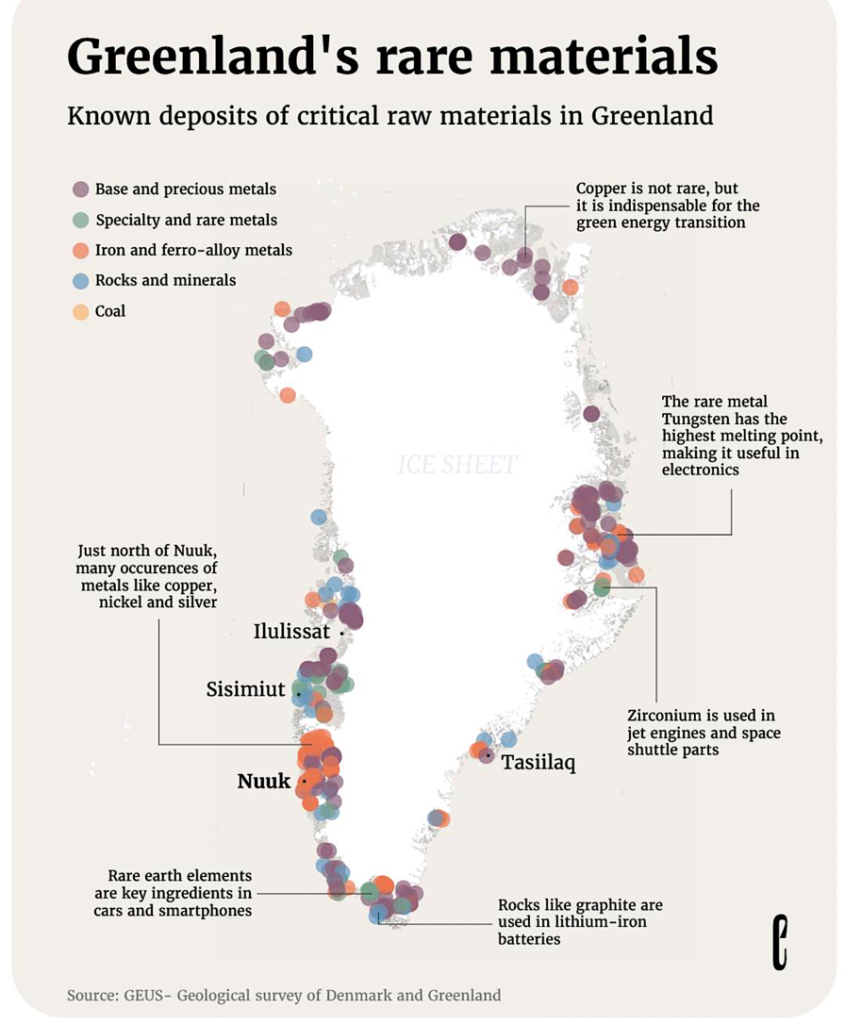

In the meantime, the world’s largest island, has become another major focal point. Greenland’s vast frozen plains are believed to hold some of the largest untapped reserves of rare-earth elements and other critical minerals. The US, under both the Trump and Biden administrations, has shown keen interest in Greenland, even offering to buy the island—a proposal that was promptly rejected by Denmark, which has controlled the island for the past 300 years. Jens-Frederik Nielsen, whose centre-right “Demokraatit party” won a surprise victory following legislative elections in March, and who must form a coalition government, countered President Trump’s persistent assertions that the United States would annex the island. In a declaration to the press, he said ‘We don’t want to be Americans. No, we don’t want to be Danes. We want to be Greenlanders, and we want our own independence in the future. And we want to build our country by ourselves.”

Greenland’s wealth of natural resources isn’t just a tempting opportunity for the United States; China and Russia have also been steadily increasing their presence there. Through investments in mining ventures and infrastructure projects, Beijing in particular has been carving out a role for itself in the region.

This has raised concern in Washington, where officials are growing uneasy about China’s expanding influence in the Arctic. As climate change continues to melt ice and open up new possibilities in the far north, the strategic importance of the Arctic is becoming harder to ignore, and the competition for control is heating up.

Canada also plays a crucial role in the global competition for resources. Blessed with enormous mineral reserves and a steady, dependable political climate, the country has been a natural partner for the United States in building a secure and reliable supply chain for essential minerals. Canadian mining firms are already leading producers of key materials like nickel, cobalt, and lithium, and the country is well on its way to becoming a central hub for processing rare earth elements (REEs).

However, the American president has recently expressed a desire for Canada to become the 51st state of the United States, sparking significant controversy and confusion. This stance is part of a broader trade conflict and economic pressure campaign against Canada, which includes imposing tariffs on Canadian goods and suggesting that the US does not need Canada’s resources. Canadian officials, including former Prime Minister Justin Trudeau and new Prime Minister Mark Carney, have firmly rejected Trump’s suggestions, emphasising Canada’s sovereignty and independence

Be that as it may, Canada’s resource industry isn’t without its hurdles. Environmental worries and the need to respect indigenous land rights add even more complexity to mining operations. These issues often slow down or complicate the extraction process, highlighting the delicate balance between economic ambitions and ethical responsibilities.

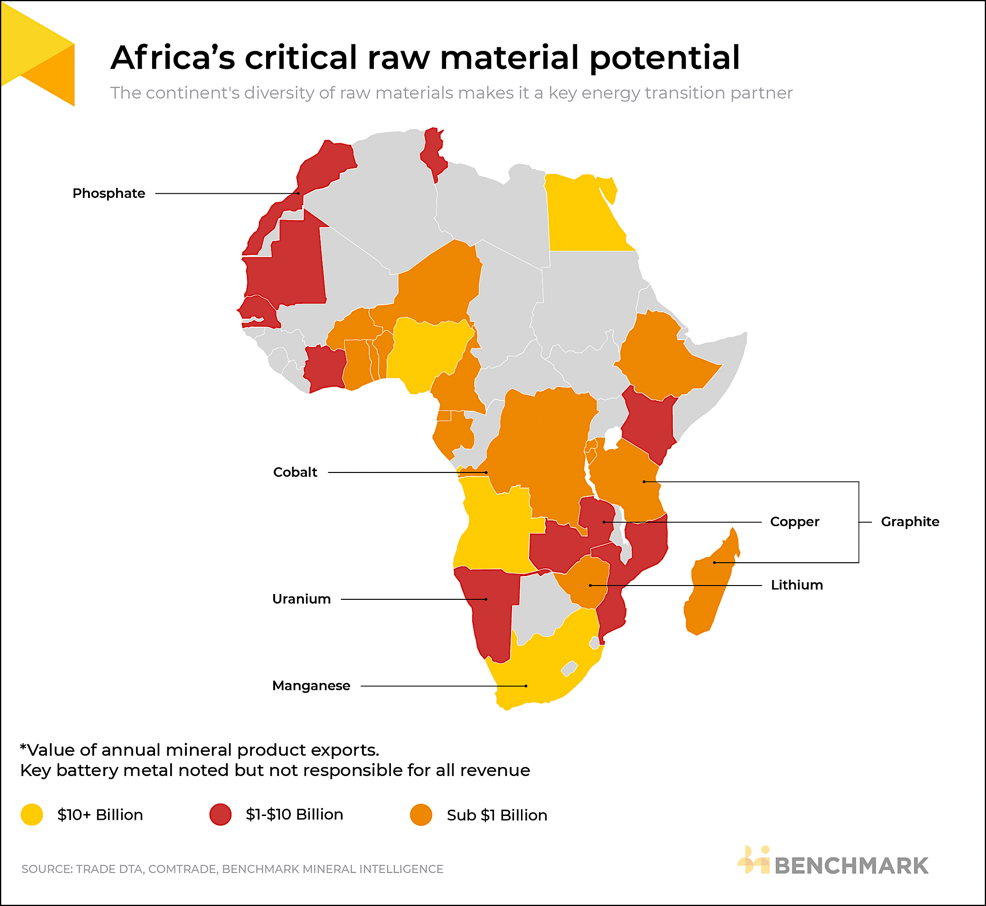

| Rich Ground, Poor Hands: Africa’s Mineral Paradox

Africa, frequently hailed as the planet’s most resource-rich continent, has become a focal point in the global scramble for minerals. Take the Democratic Republic of Congo (DRC), for example, which provides more than 70% of the world’s cobalt—a vital ingredient in lithium-ion batteries used in everything from smartphones to electric vehicles. But the DRC’s vast mineral wealth has been as much a burden as a boon. It has often been linked to corruption, violent conflicts, and serious human rights violations, leaving many to question whether the country’s riches have truly benefited its people.

China, in particular, has been making significant investments in Africa, pouring billions into mining ventures and infrastructure development as part of its ambitious Belt and Road Initiative. This has given Beijing a strong foothold in the continent, allowing it to exert considerable influence over the global supply of critical minerals. This growing dominance has not gone unnoticed, causing unease among Western nations, who are increasingly wary of China’s tightening grip on resources essential to modern technology and green energy. As Africa’s mineral wealth continues to draw global attention, the continent finds itself at the heart of a complex and often contentious geopolitical struggle.

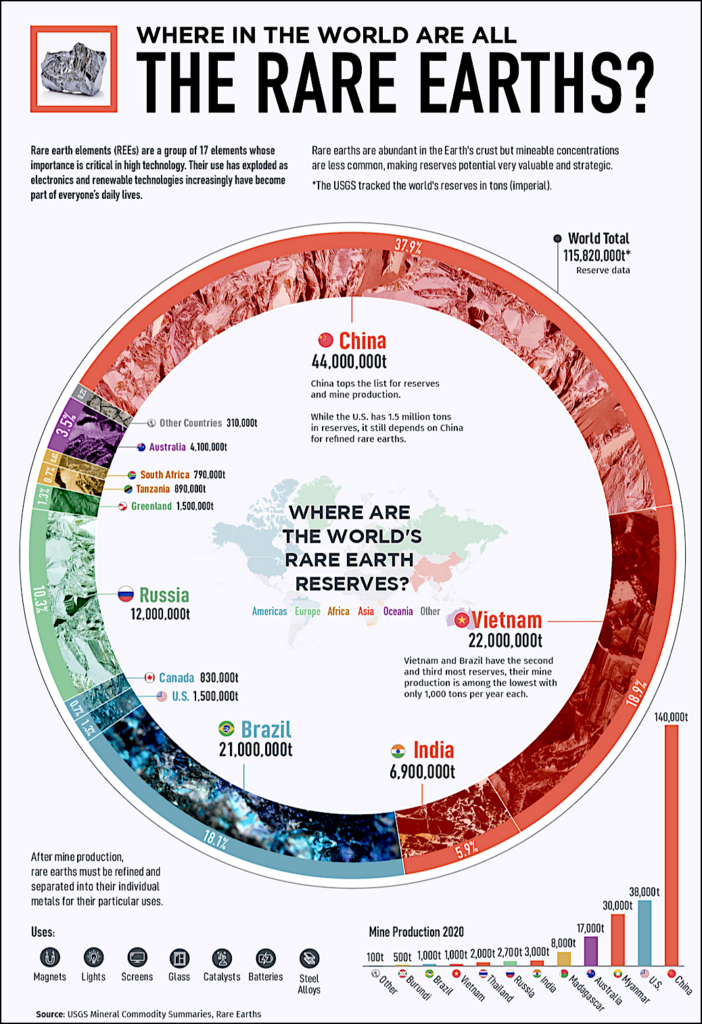

Like China, Russia also enjoys cordial relations with a significant number of African nations which have given it the opportunity to extend its control over strategic mineral reserves. But while China overwhelmingly dominates the global non-fuel critical minerals market, Russia has a similar influence over fossil fuels and some critical minerals.

Russia, in fact, holds the world’s fourth largest reserves of rare earth elements after China, Vietnam and Brazil. About 30 per cent of the global supply of platinum-group elements, including palladium, comes from Russia. It accounts for 13 per cent and 11 per cent of the global supply of titanium and nickel, respectively. Russia is also a major source of neon. There was a significant increase in the global prices of nickel, palladium and neon, alongside the increase in the prices of energy and food products, immediately after the outbreak of the conflict with Ukraine in 2022.

The China-Russia alliance, in this regard, is a serious concern for the US and its allies. Following the conflict and imposition of western sanctions, China-Russia trade saw a sharp increase. If China and Russia decide to work together on critical mineral supply chains, the US and its allies will likely face tremendous challenges.

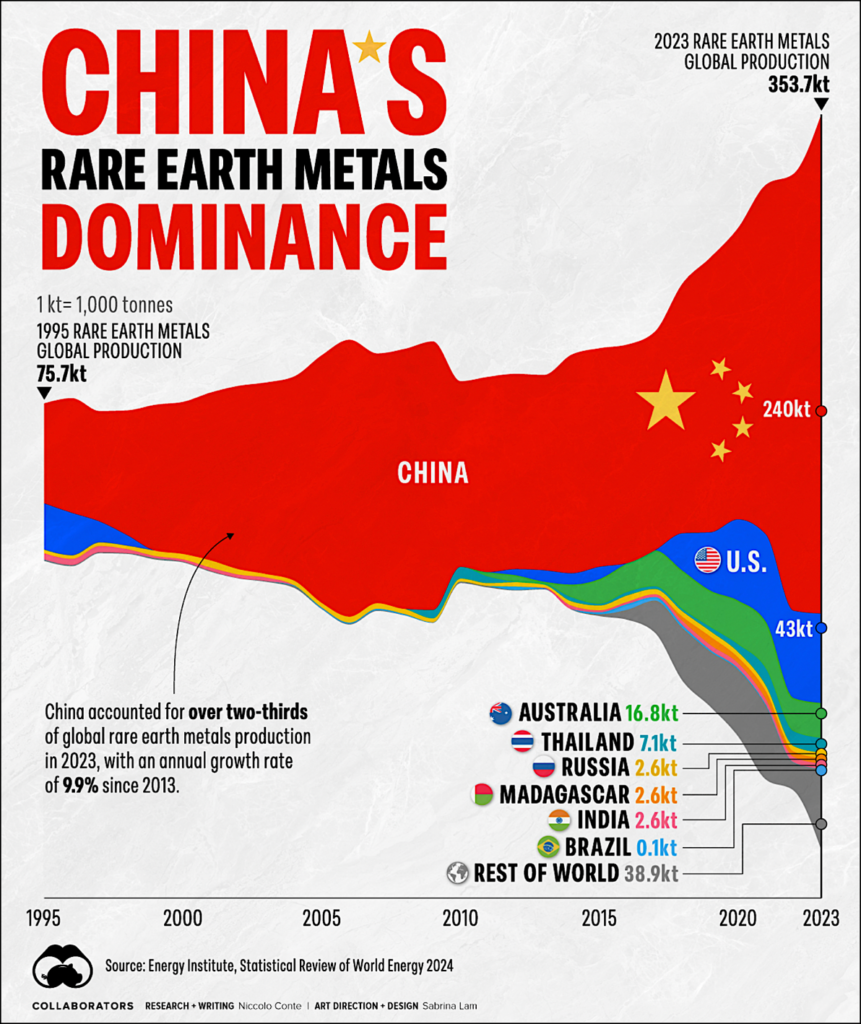

| China’s Dominance and the Global Supply Chain

China’s influence in the global market for minerals and rare earth elements is absolutely monumental. The country commands roughly 80% of the world’s capacity for refining REEs and is a dominant force in producing lithium, cobalt, and other critical minerals essential for modern technology. This isn’t a stroke of luck—it’s the outcome of a carefully crafted, long-term strategy. For decades, China has poured resources into mining projects, processing plants, and cutting-edge research, consolidating its position as the central pillar of the global supply chain for these vital materials.

This control isn’t just about economics; it’s a powerful tool of geopolitical influence. A stark example came in 2010, during a territorial dispute with Japan, when China suddenly limited its exports of REEs to the country, causing some panic across global markets. More recently, Beijing has wielded its dominance in the REE sector as a strategic weapon in its ongoing trade tensions with the United States. These actions have pushed Washington and its allies to scramble for alternative sources of supply. However, loosening China’s grip is no simple task. The complex infrastructure and specialised expertise needed to extract and process these materials are largely concentrated within China.

In March, the South China Morning Post claimed it had seen a declassified report of a geological survey in 2020 that had found enough supplies of thorium which could power the country for 60,000 years. According to the Hong Kong-based English language newspaper, the Bayan Obo mining complex in the Inner Mongolia region of China could yield 1 million tonnes of thorium from mining waste. Thorium is a naturally occurring, slightly radioactive metal, primarily found in minerals like monazite. It is a potential alternative to uranium in nuclear reactors, as it can be used to produce nuclear energy through thorium-based fuel cycles. Thorium is more abundant than uranium and produces less long-lived radioactive waste. Beyond energy, it has other uses, such as in certain high-temperature materials and coatings.

The survey, led by senior engineer, Fan Honghai with the National Key Laboratory of Uranium Resource Exploration in Beijing, identified 233 thorium-rich zones across China, clustered in five key belts from the inland Xinjiang Province to Guangdong on the southeastern coast.

This would mean that China has the world’s largest thorium reserves, and would put it on top of the list, ahead of India, Australia, Brazil and the United States. If thorium does become an important natural resource, it would give an immense boost to China’s already overwhelming economic power. And there’s every chance that thorium will join the list of other critical minerals, because it can be used for nuclear fission; it’s basically a vast supply of carbon dioxide-free energy. Creating rival supply chains is a mammoth undertaking—one that could take years, if not decades, to achieve. So, for now, China remains the undisputed heavyweight in the world of critical minerals.

| The Global Impact: Power, Inequality, and the Climate Question

The scramble for minerals and REEs has had far-reaching implications for global politics, economics, and the environment. On the geopolitical front, it is increasing tensions between major powers, particularly the US and China, as the competition for resources is not just about economic gain but also about strategic advantage. Control over critical minerals is seen as essential for maintaining technological and military superiority, and this has led to a new form of tension that can be described as “resource nationalism”. Resource nationalism and protectionism are certainly on the rise with countries like Zimbabwe and Indonesia imposing export restrictions to encourage local processing. Chile has also made moves to nationalise its lithium industry, reflecting a global trend toward greater state control over critical resources.

At the same time, the exploitation of these resources is deepening global inequalities. Many of the countries that possess rich mineral deposits and REEs are among the poorest and most politically unstable. The wealth generated from mining often benefits foreign corporations and local elites rather than the broader population, and in countries like the Democratic Republic of Congo (DRC), the mining sector is rife with corruption, child labour, and environmental destruction. This situation has raised serious ethical questions about the true cost of the green energy transition, which relies heavily on these materials.

The environmental impact of mineral extraction is another major concern. Mining is an inherently destructive activity, often leading to deforestation, water pollution, and the displacement of communities. The processing of REEs, in particular, is highly toxic, generating large amounts of radioactive waste, and although these materials are essential for renewable energy technologies, their extraction and processing contribute to the very environmental degradation that green energy aims to diminish. Basically, we need to save the planet without wrecking it even more. That’s the problem that must be solved.

| Hidden Impact of Donald Trump’s Mineral Strategy

Since taking office, President Trump has withdrawn the US from the Paris Climate Agreement, considered by many experts in the field, the most important climate pact. His administration has also started to remove or downplay references to the climate crisis across various government departments with websites of several key agencies, including the Department of State, Department of Defense and Department of Agriculture and Department of Transportation, seeing climate-related content removed. He also dismissed his predecessor’s efforts in the field of green technology as nothing more than a “green new scam”. And he famously repeated the slogan “Drill, baby drill” during his 2024 presidential campaign as well as at his 2025 inaugural address.

Yet, despite his track record of downplaying climate concerns, the American president has shown a surprising eagerness to strike deals with world leaders on the issue of critical minerals. For instance, he has actively pursued agreements with Ukraine’s president to secure access to these vital resources. His interest doesn’t stop there—he’s also turned his attention to Greenland and Canada, both of which are treasure troves of the minerals essential for modern technology and green energy. It seems that, even as he dismisses climate action, Trump recognises the strategic importance of these resources in shaping the future of energy and geopolitics.

In fact, since taking office, Trump has made securing critical minerals a top priority. As we have seen, these minerals are essential for a range of industries, particularly aerospace and defence, where they play a vital role in building advanced technologies. But there’s another, perhaps surprising, use for these resources: they’re also key ingredients in the production of green technology, such as wind turbines, solar panels, and electric vehicles.

This raises an interesting question: could Trump’s push to secure these minerals actually have a positive side effect? By focussing on building up the US’s supply of critical minerals, might he help unlock the country’s potential in the green technology sector? After all, having a steady, reliable source of these materials could give American companies the edge they need to innovate and compete in the growing global market for clean energy solutions. It’s a twist that could turn a strategic move into a win for both national security and the environment.

Trump’s close ally, Elon Musk, knows better than most just how crucial critical minerals are for the green energy revolution. The companies he leads—SpaceX and Tesla—depend heavily on these materials. Graphite is a key component in electric vehicles, lithium powers the batteries that keep them running, and nickel is essential for building rockets. Without these minerals, the cutting-edge technologies Musk is known for simply wouldn’t exist. Dr Elizabeth Holley, an associate professor of mining engineering at the Colorado School of Mines, explains that while each country has its own list of what it considers “critical minerals,” they typically include rare earth elements and metals like lithium. She points out that demand for these materials is skyrocketing. In 2023 alone, the demand for lithium surged by 30%, driven largely by the explosive growth of the clean energy and electric vehicle industries.

According to the International Energy Agency, within the next 20 years, these sectors will account for nearly 90% of the demand for lithium, 70% for cobalt, and 40% for rare earth elements. The numbers paint a clear picture: the future of energy and transportation is deeply tied to these minerals. Musk himself has been so concerned about securing a steady supply of these resources that, three years ago, he took to Twitter to voice his frustrations. “Price of lithium has gone to insane levels!” he tweeted. “Tesla might actually have to get into the mining & refining directly at scale, unless costs improve.” He added that while there’s no shortage of lithium in the ground, the speed at which it’s being extracted and processed is far too slow to meet the growing demand. This isn’t just a challenge for Musk or Tesla; it’s a global issue. As the world races toward a greener future, the ability to access and process these critical minerals will play a defining role in who leads the charge and who gets left behind.

| The US Position in the Global Race

A report published by a US Government Select Committee in December 2023 highlighted the urgent need for the United States to rethink its approach to securing critical minerals and REEs. The report warned that relying too heavily on China for these resources poses serious risks. The committee cautioned that failing to act could have dire consequences, potentially bringing defence production to a standstill and disrupting the manufacturing of advanced technologies.

China’s dominance in this market didn’t happen by accident. It stemmed from the country’s early realisation of the economic potential tied to green technology. “China made a decision about 10 years ago about where the trend was going and has strategically pursued the development of not just renewables but also electric vehicles. Now, it dominates the market,” explained Bob Ward, policy director at the London School of Economics (LSE) Grantham Research Institute on Climate Change and the Environment. In short, China saw the future and acted on it, leaving other nations playing catch-up in the race for critical resources.

Trump on the horizon. Insiders working in the sector have hinted that discussions within the White House suggest he might soon issue a “Critical Minerals Executive Order” which could channel even more investment into securing the US’s supply of these vital resources. While the exact details of the executive order are not yet known, experts familiar with the matter believe it could include steps to speed up mining activities within the US. This might involve streamlining the permit process to make it faster and easier for projects to get off the ground, as well as funding to build new processing plants. Such measures would aim to reduce the country’s reliance on foreign sources and strengthen its position in the global race for critical minerals. If these plans come to fruition, they could mark a significant shift in how the US approaches its mineral supply chain, with potential significant ripple effects across industries and geopolitics.

| The EU’s Roadmap for Critical Minerals

The war in Ukraine served as a stark reminder to Europe about the risks of relying too heavily on Moscow for its gas. As a result, and with the world situation becoming increasingly unstable, the European Union now finds itself needing to carefully examine where it obtains crucial materials for its shift to cleaner energy, including of course, critical minerals and RRE’s. The challenges are significant because of the EU’s heavy reliance on China which dominates global processing for many of the required materials.

To address these challenges, the EU introduced the Critical Raw Materials Act (CRMA) in 2023, a landmark policy that lays out clear goals for how the EU should handle critical raw materials. By 2030, the plan is for the EU to source at least 10 per cent of what it needs each year from its own mines, recycle 25 per cent, and process 40 per cent of its requirements within its borders. On top of that, the EU wants to avoid relying too much on any one country—no single nation should supply more than 65 per cent of the EU’s annual needs. It’s all about building a more self-sufficient and secure supply chain for the future.

The EU is also working to strengthen its supply chains by building strategic partnerships and making deals with trusted allies. These collaborations include countries like the United States, Japan, and South Korea. On top of that, the EU is exploring the idea of creating a Critical Raw Materials Club. This club would bring together like-minded nations to share investments and improve coordination, making it easier to secure the resources needed for the future. It’s all about teamwork and finding smarter ways to reduce reliance on a handful of suppliers.

The EU is also boosting its ability to handle shocks in the supply chain by running stress tests and building up strategic reserves. It’s pushing for sustainable investment and trade, while speeding up the use of cutting-edge technologies for critical raw materials. Efforts are also underway to create a more circular economy, recovering materials from mining waste and improving labour, human rights, and environmental standards. In short, the EU’s strategy focuses on diversifying supplies, ramping up local production and recycling, and building sustainable, resilient supply chains through global partnerships.

In whichever direction we look around the world, the scramble for minerals and REEs stands out as a defining feature of 21st century geopolitics, with profound implications for the future of our planet. Superpowers like China, the US, and Russia are competing for control over these vital resources, but as the backbone of green technologies, defence systems, and advanced industries, these materials are not just economic assets but tools of power and influence. While China currently dominates the global supply chain, the US and its allies are working to reduce their reliance through diversification, innovation, and strategic partnerships. Meanwhile, resource-rich nations and regions, from Africa to the Arctic, find themselves at the centre of this high-stakes game. The challenge lies in balancing the urgent need for these resources with the ethical, environmental, and social costs of their extraction. As the competition intensifies, the choices made today will shape not only the future of global power dynamics but also the sustainability and equity of the world we leave for generations to come. The race for critical minerals is more than a geopolitical contest—it’s a test of humanity’s ability to collaborate in the face of shared challenges.

hossein.sadre@europe-diplomatic.eu